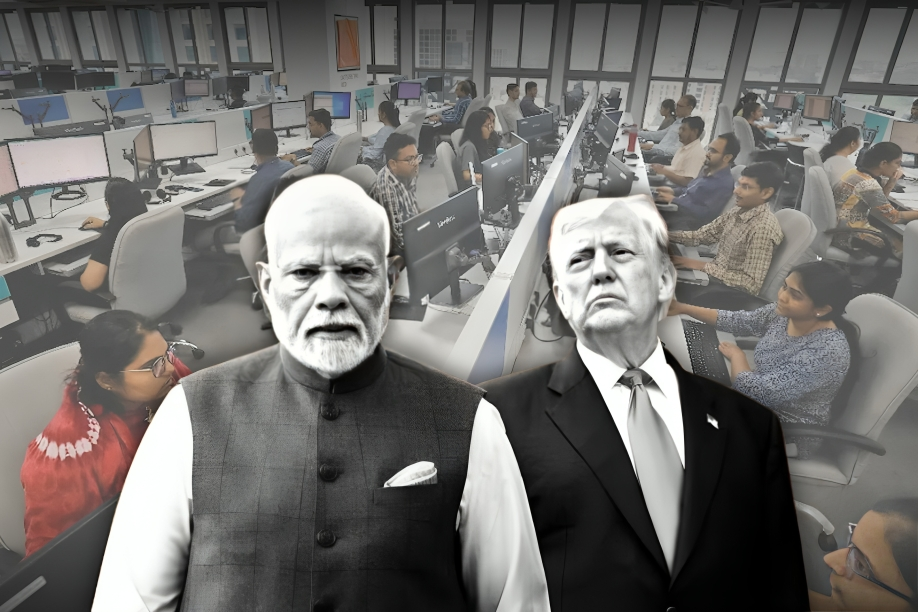

Indian IT companies are facing turbulent times. Firstly, it is the Job cuts and layoffs being announced due to AI and automation of jobs. Secondly, it is the looming threat of the US proposing a 25 percent tax on American Firms, who are outsourcing work to Indian IT companies.

The Indian IT sector has flourished for decades since the Internet boom in 90's thanks to outsourcing. American firms have been outsourcing a good chunk of their work to Indian Firms, creating a supply chain that benefits both countries and economies. According to a government estimate, Indian IT firms like Infosys, TCS, and HCL Tech have raked up profits in millions, meanwhile creating jobs in India.

Indian IT Sector Economics?

The Indian IT sector is worth 283 billion dollars, exporting software services to American clients. The client list includes some Big-Tech firms like Apple, American Express, Cisco, Citigroup, FedEx, and Home Depot. Economically, this has translated to about 7 percent of the GDP, creating job opportunities. Overall, the outsourcing of several pivotal services helped reduce costs for US companies.

What is the bill threatening Indian IT companies?

US Republican Senator Bernie Moreno recently tabled the HIRE Act. The two challenges that this bill poses for the Indian IT sector are, firstly, it proposes taxing companies that hire non-American citizens, and secondly, it proposes taxing companies that outsource IT services to countries abroad, like India.

What challenge are IT firms facing?

The biggest challenge in these turbulent times for Indian IT firms is multifaceted and complex. Many US companies have now been deferring or updating existing contracts to safeguard themselves in case the bill comes into effect. Moreover, the firms deciding to brave out the storms are reducing less important tech spending to control debt and losses.

Meanwhile, the US companies that are outsourcing IT services to Indian firms could earlier claim outsourcing payments as tax-deductible expenses. Another thing bothering US tech firms is the high cost of labour in the US, which was significantly lower in India.

The Indian and US companies will most likely lobby sharply to prevent the HIRE bill from becoming an act. "A bill like this would probably face a lot of backlash from US companies that rely heavily on outsourcing, who would likely bring litigation to challenge various aspects of the bill, if it were ever to be passed into law," said Alcorn Immigration Law CEO Sophie Alcorn.

Indian Industry Stance on HIRE

"The HIRE Act proposes sweeping changes that could alter the economics of outsourcing and significantly increase the tax liability associated with international service contracts," EY India's compliance head Jignesh Thakkar said. In some cases, combined federal, state and local taxes could push the levy on outsourced payments as high as 60%, Thakkar said.

"While its partisan proposal may seem initially attractive, it's ultimately an artificial cost which makes organisations less competitive and profitable globally," said Arun Prabhu, partner at Cyril Amarchand Mangaldas.

"When political noise turns into regulatory risk, clients quickly insert contingencies, reopen pricing, and demand delivery flexibility," said HFS Research President Saurabh Gupta. "Clients will simply take longer to sign, longer to renew, and longer to commit transformation dollars," Gupta added.